sales tax on leased cars in texas

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. States charge sales tax on the total value of the vehicle.

Nissan End Of Lease Options Nissan Usa

Sales tax on leased cars.

. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. A A tax is imposed on every retail sale of every motor vehicle sold in this state. Like with any purchase the rules on when and how much sales tax youll pay.

Texas Sales Tax on Car Purchases. Vehicles purchases are some of the largest sales commonly made in Texas which means that they can lead to a hefty sales tax bill. In the state of Texas you pay 625 tax on Trade difference.

Car youre trading 30000. Car youre buying 50000. A Except for purchases by franchised dealers described in this subsection motor vehicles that are purchased by a lessor to be leased are.

Texas law requires the owner the leasing company to pay sales tax on the total value of a vehicle they buy from a dealership and rent to a renter you and me. Texas residents 625 percent of sales price less credit for. A lessee who purchased a leased vehicle brought into Texas may claim a credit for either the use tax or the new resident tax paid by the lessee against any tax due on its purchase.

Sales tax is a part of buying and leasing cars in states that charge it. Posted on April 17 2022. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

Read real discussions on thousands of. Heres an explanation for. Motor Vehicle Leases and Sales.

For vehicles that are. Except as provided by this chapter the tax is an obligation of and shall be. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The sales tax differs from state to state. Hi in Texas do you have to pay sales tax on a leased vehicle upfront. The sales tax for cars in Texas is 625 of the final sales price.

The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local. Trade Difference 20000. For example in Texas youll have to pay 90 a year in property tax.

Sales tax is a part of buying and leasing cars in states that charge it.

Rentals Leases How Does Sales Tax Apply To Them Sales Tax Institute

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

When Should You Lease Your Car Here S The Best Time To Do It Shift

Texas Used Car Sales Tax And Fees

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Car Leasing And Taxes Points To Ponder Credit Karma

Texas Car Sales Tax Everything You Need To Know

Is It Better To Buy Or Lease A Car Taxact Blog

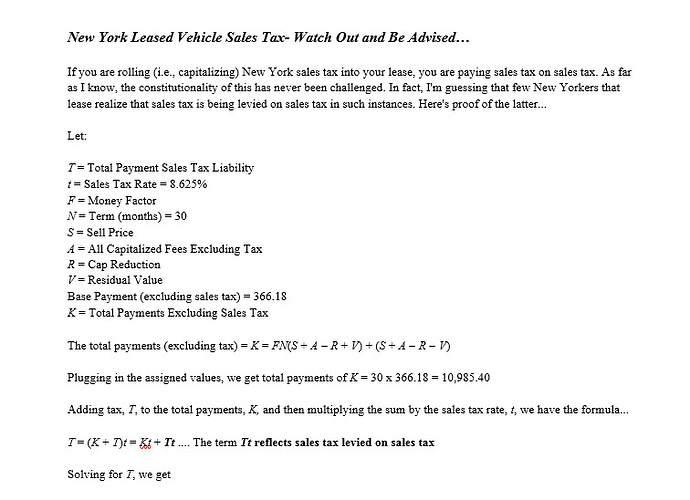

Sales Tax In Ny Off Ramp Forum Leasehackr

Used Coupes For Sale In Houston Tx Cargurus

Is Buying A Car Tax Deductible Lendingtree

As Demand For Cars Falters Auto Prices Are Poised To Fall

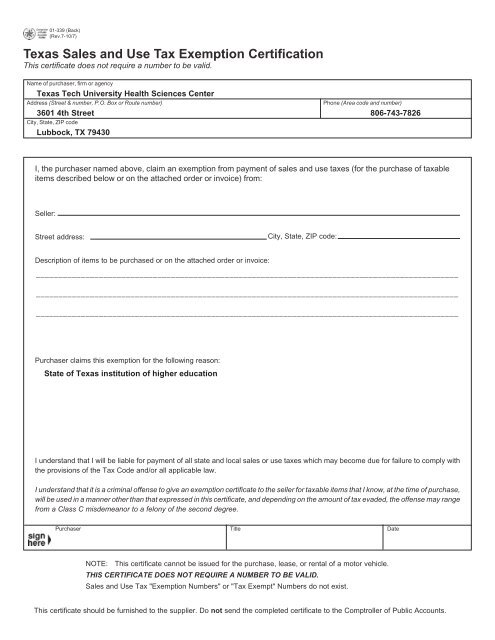

Texas Sales And Use Tax Exemption Certification Texas Tech

Texas Sales And Use Tax Exemption Cert Olden Lighting

The Top Is There Sales Tax On A Leased Car In Texas

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz