does doordash do quarterly taxes

This means you will be responsible for paying your estimated taxes on your own quarterly. How do Dashers pay taxes.

How Do I File Doordash Quarterly Taxes Due Septemb

- All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

. The bill though is a lot steeper for independent contractors. Last year on 57000 income betweeen DoorDash and postmates I paid 390 in taxes. E-delivery through Stripe Express.

Well You estimate the taxes that will be owing on your earnings. One of the most popular food delivery brands today is DoorDash. This way i decide how many miles i went a day if you get my drift.

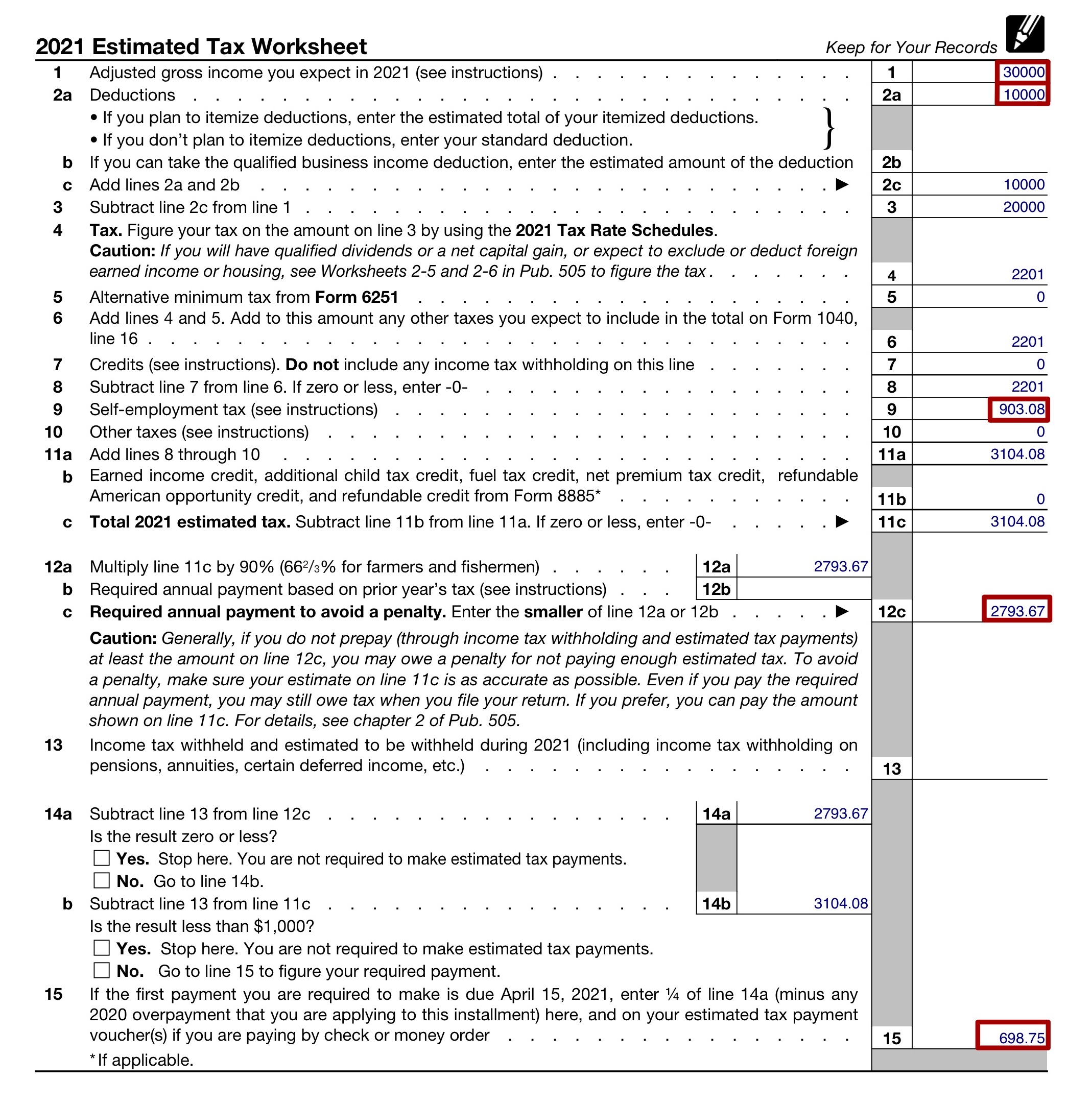

You will have to keep a mileage log but DoorDash recommends a discounted service to. Form 1040-ES will ask you to use your expected adjusted gross income AGI to estimate your owed tax. How To Calculate Quarterly Taxes.

You can also use the IRS website to make the payments electronically. Get help with your DoorDash taxes. The answer is no.

If you wait until April to pay you could have to pay a. It may take 2-3 weeks for your tax documents to arrive by mail. If youre a Dasher youll need this form to file your taxes.

This article provides answers to some of the most frequently asked questions about DoorDash taxes. I personally keep a mile log in notes on my phone. Discover short videos related to how does taxes work on door dash on TikTok.

Dashers should make estimated tax payments each quarter. Paper Copy through Mail. Form 1099-NEC reports income you received directly from DoorDash ex.

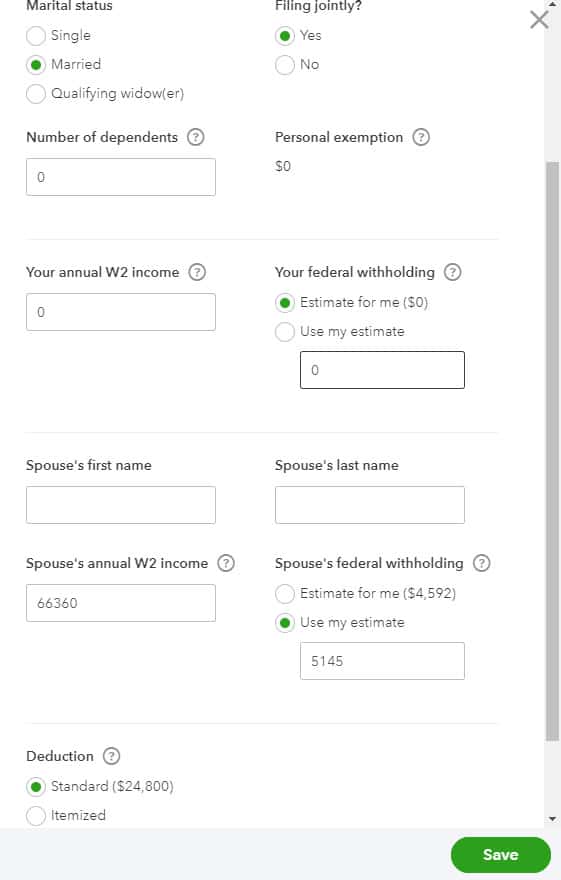

So if you have other income like W2 income your extra business income might put you into a higher tax bracket. So Why Does Doordash Not Withhold Our Taxes. Incentive payments and driver referral payments.

There are various forms youll need to file your taxes. Collect and fill out relevant tax forms. Form 1040-ES is used to report estimated tax for this year while Form 1040 is used to report your actual income from a previous year.

You will pay to the Federal IRS and to the State separate taxes. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

Each year tax season kicks off with tax forms that show all the important information from the previous year. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. Your biggest benefit will be the mileage deduction which is 0545 per mile. Answer 1 of 4.

DoorDash does not automatically withhold taxes from your paycheck as of 2022. You will have to keep a mileage log but DoorDash recommends a discounted service to do that for you. Here are the three steps youll want to follow.

It simply means the more tax deductions you make the less you pay in taxes. The forms are filed with the US. Be aware the due dates arent exactly quarterly.

Watch popular content from the following creators. As an independent contractor you are. Still DoorDashs partner Stripe sends you a 1099-NEC form via email or regular mail if you.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. DoorDash does not take out withholding tax for you.

Internal Revenue Service IRS and if required state tax departments. Calculate what you owe. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your.

Watch popular content from the following creators. Do i have to pay taxes for doordash 2B views Discover short videos related to do i have to pay taxes for doordash on TikTok. A 1099 form differs from a W-2 which is the standard form issued to employees.

Tamariustamariustalks Breyanna Nava breyannanava Natasha Knatasha21k Kenzbambamsowner ganaganadelrey Tamariustamariustalks 𝕵𝖚𝖘𝖙𝖎𝖓jaythedasher Tax Professional EA dukelovestaxes. An independent contractor youll need to fill out the following forms. FICA stands for Federal Income Insurance Contributions Act.

As such it looks a little different. Does DoorDash Take Taxes Out In 2022. This means you will be responsible for paying your estimated taxes on your own quarterly.

Then I adjust it at end of year to more or less miles as needed. The process of figuring out your DoorDash 1099 taxes can feel overwhelming from expense tracking to knowing when your quarterly taxes are due. Instructions for doing that are available through the IRS using form 1040-ES.

If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. Does doordash do quarterly taxes Sunday May 29 2022 Edit The Federal Insurance Contributions Act FICA requires a tax on employees wages as well as contributions from employers in order to fund the USs Social Security and Medicare programs. Technically both employees and independent contractors are on the hook for these.

To file taxes as a DoorDash driver aka. Does Doordash take taxes out of my paycheck. Because you work as an independent contractor when you deliver for DoorDash you are responsible for keeping track of your earnings.

IRS will come knocking if you dont know what to do. DoorDash does not provide Dashers in Canada with a form to fill out their 2020 taxes. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

Tax Professional EA dukelovestaxes Ahad the CPA Tax Expertahadthecpa Adi Adaratheadiadara Hannahhailhannah666 Tamariustamariustalks.

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How Does Doordash Do Taxes Taxestalk Net

How Do Food Delivery Couriers Pay Taxes Get It Back

How Do Food Delivery Couriers Pay Taxes Get It Back

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Does Doordash Do Taxes Taxestalk Net

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do I File Estimated Quarterly Taxes Stride Health

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier